Clarification regarding questions about forest valuation etc

- News

- Company news

SCA answers questions relating to the valuation of forest assets, harvesting, forest damage, and accounting-related matters.

With this document, SCA wants to contribute to transparency surrounding questions that have been raised in recent weeks regarding the size and valuation of SCA’s forest assets, harvesting in relation to forest assets, forest damage, and accounting-related matters.

Well-managed forests and transparent accounting have long been key success factors for SCA. Our ambition is to always be transparent and clear regarding the company’s assessments and what these are based on.

With this report, we wish to clarify facts concerning forest assets, forest valuation, harvesting, forest damage, and accounting-related matters.

Our ambition is that these clarifications provide a clear and concise picture of how SCA’s long-term efforts to increase forest assets creates conditions for value creation over time and for SCA’s continued development.

Forest assets

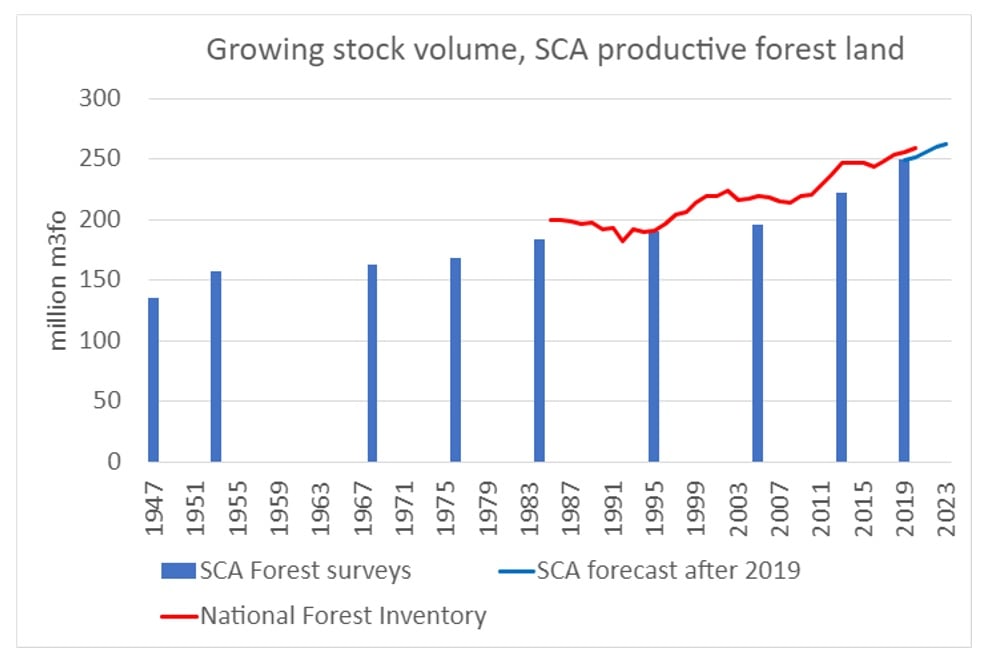

SCA regularly conducts its own inventories of its forests, as it has done since 1947. These inventories form the basis of strategic decisions regarding long-term forest management and the supply of wood. Results from inventories are compared with data compiled by the Swedish National Forestry Inventory.

The Swedish National Forestry Inventory is conducted by the Swedish University of Agriculture (SLU), Sweden’s authority for official statistics on the condition of, and changes in, forests. SLU conducts annual surveys of sample areas all over Sweden and produces statistics at national and regional level. SCA commissions SLU to quantify forest resources based on sample areas of the company’s land, thereby providing an independent verification. SLU’s results are in line with SCA’s own measurements. SCA inventories typically show lower total volumes in comparison with Swedish National Forestry Inventory data.

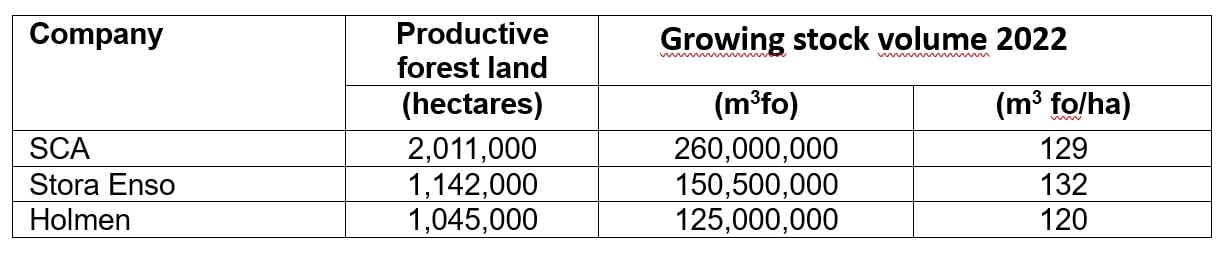

The industry standard for reporting productive forest resources is forest cubic meters1 (m3fo) per hectare of productive forest land. This is a key figure for assessing the size of forest assets and the future availability of forest raw materials.

In its 2022 Annual and Sustainability Report, SCA reported forest assets in Sweden amounting to a total of 260,000,000 cubic meters of forest on 2,011,000 hectares of productive forest land, that is, an average of approximately 129 cubic meters of forest per hectare (m3fo/ha).

The average is well in line with comparable reports that other Swedish forestry companies make in their annual reports 2.

Forest valuation

Forest land is considered a real asset with low risk, one that also offers protection against inflation. Forests grow irrespective of economic conditions, while the demand for renewable raw materials is expected to continue to increase.

Similar to other major forest companies, since 2019 SCA has based its valuation of forest assets in Sweden on completed forest land transactions. The value of SCA’s forest assets is calculated by applying the average price level of transactions in the geographical areas where SCA owns forests, weighted by volume based on how SCA’s forest assets are distributed geographically.

Market statistics are obtained from two independent suppliers, Ludvig & Co and Svefa. To ensure that the amount of transactions gives as an accurate picture as possible of market value, a three-year average market price is used.

Ludvig & Co’s statistics are based on forest land transactions brokered by Ludvig & Co. Their database only includes transfers of properties that have been made on the open market.

Svefa’s statistics are primarily based on property deed data for forest properties. In order to provide reliable statistics, Svefa does not include transactions of less than 10 hectares of forest, transactions where forest land makes up less than 75 per cent of the transaction value, or properties that are classified as “special properties”.

The last category that is filtered out includes properties where there may be other value-influencing factors than the pricing of land. This might include wind farms or transfers between legal entities, which typically take place at higher price levels than other forest property transfers.

Neither does Svefa include transactions with outlier values, for example transactions in which growing stock volume is extremely low per hectare. This is done to filter out misleading data or factors that are unrelated to forestry.

SCA’s own forest land transactions constitute only a small proportion of the database that forms the basis of forest valuations. SCA’s share as a buyer or seller in Ludvig & Co’s database for the four northernmost counties of Sweden for 2022 and 2023 amounts to approximately four per cent of the total purchase price of forest land and approximately two per cent of the number of transactions, see Ludvig & Co, share of transactions and share of purchase price. In the Svefa database, SCA’s transactions constitute approximately two per cent of transactions during the same period, and as a share of total transaction value, SCA’s share corresponds to approximately eight per cent, see Svefa, regarding selection of local price material.

A significant proportion of SCA’s own forest land transactions take place in the form of property reallotment or off market transactions, which result in a limited amount of data for the database. Therefore, not all SCA transactions are included in Svefa’s database. Ludvig & Co’s database only includes transactions brokered by Ludvig & Co of properties that have been offered on the open market.

In recent years, the average transaction size of SCA’s forest valuations has been between 60 and 137 hectares. Forest properties of that size in northern Sweden are rarely acquired for purposes other than forestry.

Private forest land transactions form a large proportion of the statistical data that SCA receives, and which forms the basis for forest valuations. This is because the number of company transactions is too few to reach a reliable statistical basis for forest valuation. Larger forest holdings and forest holdings owned by legal entities have historically been traded at a premium to smaller forest properties. See Svefa’s presentation (from page 21) of SCA’s capital market day in November 2022.

The total value of SCA’s forest assets is divided between biological assets and land. To determine the value of biological assets, a discounted cash flow (DCF) model is used. When cash flows are discounted, a rate of return is used that reflects the rate of return required for discounted cash flows to correspond to the total fair value according to current market prices. For 2022, SCA used a discount rate of 3.5 per cent after tax and for 2023 a discount rate of 3.6 per cent after tax, which is in line with that used by other major forest companies. The return requirement for investments in forest assets reflects the long cycle of the forest and is not affected by short-term variations in market interest rates. Since the total value of forest assets is based on market statistics for areas where SCA owns forests, the discount rate only affects the distribution of the value between biological assets and land assets.

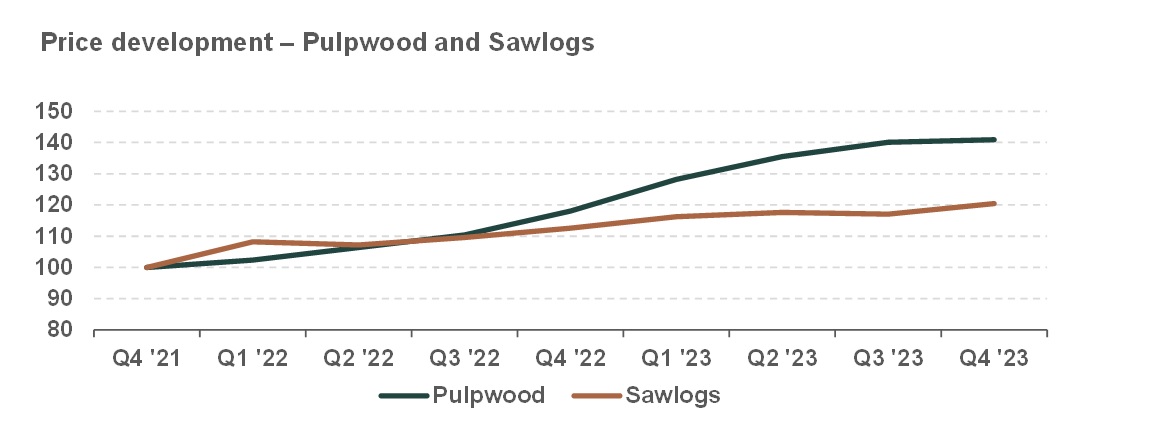

Raw material prices for wood in northern Sweden

The value of forests is positively affected by higher prices for wood raw materials (timber and pulpwood). The prices of wood raw materials have increased in recent years, while the prices of sawn wood products, for example, have fallen during the corresponding period.

The graph below shows the development of SCA’s price for pulpwood and timber taken from the report presentation for the fourth quarter of 2023.

Harvesting in relation to forest resources

SCA’s flows of raw materials consist of two components: timber from its own forest stocks and purchases from other landowners. The company has a degree of self-sufficiency in wood raw material of around 50 per cent. The remaining 50 per cent consists of external purchases from larger and smaller private forest owners.

The basis for the supply of raw materials from the company’s own forest is the company’s harvesting plan, which is continuously updated to quantify harvesting levels over the next five to ten years based on the forest supply and expected developments for more than one hundred years into the future.

Forecasts for harvesting in our own forests and standing timber volume are described on page 28 of SCA’s 2022 Annual and Sustainability Report. The principle that governs this planning is that it should be able to increase the supply of raw materials from the forest gradually over time with active forestry.

This principle has been applied since the company’s first inventory of its assets was carried out in 1947. Performance is monitored with comparisons with National Forestry Inventory sample areas. The calculations made by SLU, via the National Forestry Inventory sample areas on SCA land, also clearly show a steadily increasing stock volume on SCA land.

This is made possible by the fact that felled volumes are lower than the growth that takes place in the forest, combined with investments in increased growth through, among other things, active forest management and breeding of forest plants. SCA harvests approximately 70 per cent of the annual growth in productive forest holdings.

Forest damage

Damage to Swedish forests affects forest owners in different ways and is something everyone in the industry experiences, plans for, and jointly tries to address.

In 2022, SLU conducted an inventory of young forests in northern Sweden and found that moose grazing damage is the most common cause of forest damage3.

Grazing damage from animals is common throughout Sweden and is by its nature not company-specific. This damage can also be reduced through active wildlife management.

Another common type of forest damage is attack by Törskate fungus. According to the National Forestry Inventory, this occurs on about one per cent of the pines in the northerly most counties of Sweden, with a higher proportion, (5-10 per cent), in Norrbotten4, where SCA has just over 10 per cent of its growing stock volume.

At the same time, the Forestry Research Institute of Sweden has shown that Törskate has a relatively moderate impact on the growth of pine stocks4. Research is also underway, in which SCA participates, to find methods to prevent damage from the fungus.

Accounting-related matters

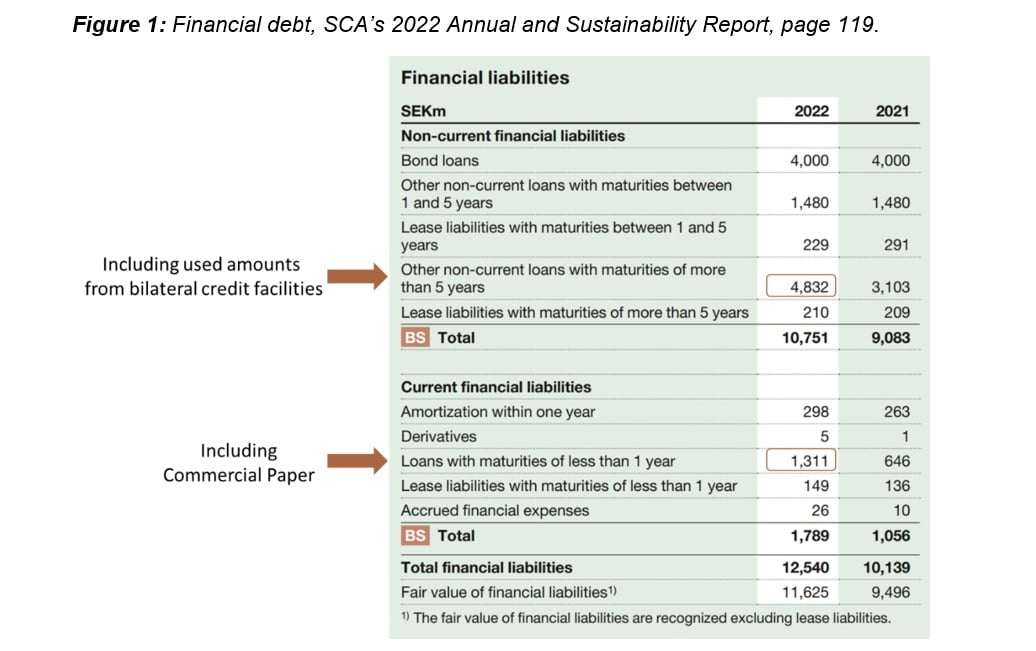

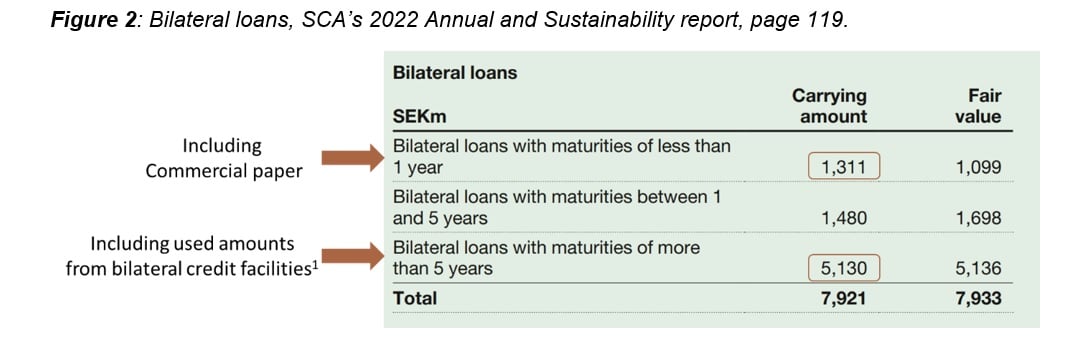

All financial liabilities are included in SCA’s annual and quarterly reporting. This information, which includes commercial papers and credit facilities, can be found on pages 119-120 of SCA’s 2022 Annual and Sustainability Report.

Commercial paper

Commercial paper is reported in the balance sheet under Current financial liabilities, under Loans with maturities of less than 1 year, see figure 1. At the end of 2022, and thus in the Annual Report, the reported value was SEK 597 million of the issued amount of SEK 600 million.

Commercial paper is also included in the information table for bilateral loans under Bilateral loans with a maturity of less than 1 year. Excluding commercial paper, the amount was SEK 714 million, see figure 2.

1 The SEK 5,130 million amount also includes upcoming amortisations, which are reported in the balance sheet as Amortization within one year, SEK 298 million, see figure 1.

An overview of the debt maturity profile and the proportion of financing from various loan sources is published quarterly by SCA. This overview includes commercial papers. The publication takes place on SCA’s website under Funding – SCA.

Credit facilities

SCA’s credit facilities are described in note E4 on page 120 of the 2022 Annual and Sustainability Report, where the facility amount, maturity and used and unused amounts are displayed. Maturity refers to maturity on the respective credit facility. This should not be confused with maturity of the amount used under the facility. At the end of 2022, used amounts were loans with final maturities between 2029 and 2031and consequently reported in the balance sheet under Non-current financial liabilities as Other non-current loans with maturities of more than 5 years.

In order to provide information about SCA’s liquidity reserve, the unused portion of credit facilities is reported in SCA's quarterly reports under the section Financing.

Net debt

Net debt is calculated in accordance with the net debt definition stated in SCA’s 2022 Annual and Sustainability Report. How the calculation is made and what it includes is shown in SCA’s 2022 Annual and Sustainability Report, page 94.

Any questions

If you have any questions regarding these clarifications, please contact SCA’s Investor Relations team at ir@sca.com.

Andreas Ewertz

CFO

Footnotes

1. Forest cubic meters specifies the volume of timber including tops and bark, but excluding branches, stump and roots.

2. See Stora Enso’s 2022 Annual Report p. 171 and Holmen’s 2022 Annual Report p. 17.

3. Wulff, S. et al., 2022. Inventering av skador på ungskog 2022 i Norrbottens, Västerbotten, Västernorrland och Jämtlands län. National Forest Damage Inventory, SLU

4. Fredriksson, E. et al., 2023. Produktionsnedsättning i törskateangripen gallringsskog. Working report 1163-2023, the Forestry Research Institute of Sweden.